This blog post guarantees a clear understanding of NFTs and options to Make Money with NFTs. Even if you do not intend to invest in NFTs, read through this article, as educating yourself about it may improve your odds of betting right in the future. We have tried to handpick the best strategies to Make Money from NFTs in future. Enjoy!

In 2021, the NFT market size was $15.53 billion and was expected to reach $73.90 billion by 2028 (Source: Report published by Business Research Insights)

NFT/ Cryptocurrency is a sunrise industry. In the future, it is bound to become a substantial source of side income / passive income or even full-time income.

The only hindrance is a lack of understanding about the way they work. It’s not a Ponzi or get-rich overnight scheme. We can go on and on but let us stick to making money from this sunrise industry.

Before we look into how to earn real money from NFTs, let’s understand NFTs.

What is an NFT?

(I understand NFTs. Take me directly to strategies to Make Money from NFTs)

NFT stands for “Non-fungible Token”, a digital, unique, non-reproducible work.

What is ‘Fungible’?

Something fungible means you can readily replace it with something equivalent, and that’s fine for everyone concerned.

For ex., a dollar bill is fungible because if someone rips up a dollar bill in your wallet, they can replace it with another dollar bill, and it makes no difference to you as both of those dollar bills spend the same.

One 5-gram coin of pure gold is functionally the same as another 5-gram coin of pure gold if you’re using it as a store of value. They’re designed to be equivalent and interchangeable.

Remember that to be fungible, the two items must be functionally identical. One share of Company A might be the same price as one Share of Company B, but you can’t just swap those shares even if they’re technically worth the same.

However, consider Scrooge McDuck’s Number One Dime, also known as the Lucky Dime, which brings him good luck. If someone rips up that lucky dime, then replacing it with another dime just isn’t going to make up. It’s no longer a fungible item.

Consider the first edition of Batman Comic, signed by the creators Bob Kane and Bill Finger – this is a non-fungible copy of a book. They’re just not making any more. People/ Collectors are willing to pay a premium to get that unique copy, even if they’re not technically getting more out of it.

That’s why an original Picasso costs so much more than even the most skilled reproduction. You’re not just paying for the look of the painting but for the fact that it’s a Picasso.

What is Fungible in digital context?

Similar is the case with digital assets such as digital art. But how do you have something special, considering that technology allows you to create an exact copy in no time?

That’s where blockchain comes in. Blockchain is the technology to ensure that you own a ‘limited edition’ version of digital art, which would otherwise be infinitely reproducible.

There is a standard that allows issuing NFTs on a blockchain. And there’s a way to prove fakes from the real thing. You can do it by running a “full node”. A “full node” is just software that checks everything on a blockchain for fakes. And when a fake is found, it’s rejected.

Coming back to the NFTs, these are digital representations on the blockchain network.

For example, you might have read about Jack Dorsey’s Tweet, which got sold for $2.9 M. So, this is a digital asset. If you are the owner of Jack Dorsey’s Tweet, you probably can’t do much with it.

When you own an NFT, for example, a CryptoPunk, you own an address on a blockchain network. You can’t change this or remove the cigar this CryptoPunk is smoking!

You can’t hide it or show it like in the case of a physical painting.

What are the real Use Cases or Utilities of NFTs?

One: Limited Supply, Can’t Modify, and It’s rare.

For example, there are only 10,000 such crypto punks, and they are on the ERC or Ethereum chain network. And because there are only 10,000 such crypto punks, that will be there forever.

If the NFT market continues to exist in 2050, 2080, and 2090, these CryptoPunks will become like dinosaur eggs – super rare.

A dinosaur egg inherently might not have a lot of value, but it has value because it is super rare.

And that is the reason why people are buying CryptoPunks at such high rates because NFT is the start of an artistic movement. If you are an early adopter of this movement and CryptoPunks have defined this movement, then this becomes a very rare commodity. And this is what gives power to CryptoPunk type of NFT.

Now, it appears that with the help of software, you can create a copy of CryptoPunk. But no, you can’t do so because there is something called smart contract technology. Simply put, in Smart contract, there is a specific set of rules associated with this CryptoPunk, which strictly allows only 10,000 unique CryptoPunks to exist worldwide. So, you can’t create 10,001th CryptoPunk, and there is a rare supply of CryptoPunk, which makes them very valuable.

Now you may argue that there’s no inherent value, but the same argument can be made for anything first of its kind. For example, the first typewriter- it’s an old piece of equipment, but you have the first typewriter in the world that’s rare, and people will pay an insane amount of money for that typewriter. So that is the concept of rarity. And that’s the first thing that gives power to NFTs.

Two: Proof of Ownership

For example, here’s another very popular NFT – Boring ape NFT.

This Boring Ape NFT was owned by Steph Curry, a massive NBA star and big influencer. How does this make anything valuable? Because Steph Curry holds it.

Think about it this way. For example, if someone discovers a cigar box of Hitler, will those cigars have any value? Absolutely yes. And that is because Hitler owned it.

The bottom line is that the ownership of an article or asset by an influential person, a star or a big influencer makes it a unique piece. And what certifies its ownership- it’s the smart contract that says that Steph Curry owned it at one point in time.

Now Steph Curry decides to sell this boring ape NFT to say Mr Somebody. Now would this boring ape NFT still be useful? Yes, because the smart contract certifies that Steph Curry used to own this NFT, and now Mr Somebody acknowledges it. So, the value goes up.

The blockchain network is so designed that the proof of ownership can be precisely traced. For example, finding how different addresses own many bitcoins is straightforward, so the proof of ownership is evident.

So, because the proof of ownership is apparent, it gives me social bragging rights. For example, if you buy Jack Dorsey’s first tweet NFT, media people will ask you to comment, ” Why did you buy this? Then you’ll be invited to some news channels, to some newspapers. So, this gives you social bragging rights. And thus, this proof of ownership context associated with NFT is compelling and valuable.

Three: NFTs are Tickets

Tickets that fetch real-world utilities: A range of NFTs can act as tickets. For example, when Rapper Snoop Dogg launched his NFT, he could have easily said that whoever owned his NFT would get one dinner date with me or something, so that became a ticket.

Similarly, if you own Mark Cuban’s NFT, you can watch Dallas Mavericks play basketball. So that becomes like a ticket-based NFT, which has real utility worldwide.

Another example is a governance-based NFT.

For example, Mana is a token used in the Decentraland Metaverse. Imagine Mana tokens can allow you to vote on Decentraland.

So, if you own these Mana tokens, governance tokens, you can tell Decentraland what changes to make.

Game utilities: For example, there is a parcel of land on Decentraland, which you can buy for 3.49 Ethereum (one of the cryptocurrencies). You can sell this land you own or use this piece of land to, say, build something on this and then you can sell that property. And this will be useful because many people are moving to this new planet called Decentraland.

Trading NFTs: If you own this land on Decentraland, you can quickly sell it to others on platforms such as OpenSea. And people buy it because they believe that decentral and will grow as these different ecosystems grow. Their NFTs and tokens associated with them will also increase. So, this is the real-world utility of these NFTs.

NFTs are not always Good

There are a few things that you must remember from a risk point of view.

One: Understand the concept of rug pull.

Rug pull is a technical term. Simply put, you have purchased some NFT, and the project gets abandoned.

For example, if you buy Mana tokens and the people building Decentraland (a famous metaverse project) run away, that project has been abandoned, and all your money is lost.

And these are very easy to figure out.

There are four specific steps to identify projects designed to cheat ordinary people.

First and foremost:

Whenever you invest in any NFT project, look at the background of the team or the artist launching it.

For example, American rapper, songwriter, and record producer Eminem recently launched his NFT. Eminem may want to make $10 M or $20 M from his NFT, take your money, and run away. That is not the intent with which he would have launched his NFT. That is nearly impossible.

Similarly, in the case of Decentraland, go and read their white paper.

You will see the founder’s details. Check their backgrounds. Do they look like legitimate people or not? Is the project backed by any VCs because

VCs do a lot of due diligence before investing in these projects. So, these are the basic hygiene check that you should do.

Secondly:

You must understand the marketing game behind the project. In several cases, you will find that the person supporting the project or marketing does one tweet or small post. That tells them they have no stake in the game and are not partnering up with the projects.

Any person who is marketing such projects should have more significant stakes.

Thirdly:

Check the involvement level of the company or Metaverse in which you invest. Are they even educating their customers? Are they holding ‘Ask Me Anything Sessions’ (AMAs)? Do they have a discord server? Do they reply to queries?

So, NFT is an evolving space, so saying that NFT has no value and fundamentally dismissing is incorrect. Again, saying that no scams happen in the NFT space is also wrong.

Like any other investment instrument, say Stocks, you must understand the NFT space, gain more knowledge about it, study the project and then invest.

Two: NFT space is fast evolving

NFT is a new-age instrument. Volatility will be high when it comes to NFT investing. Anything new has immense potential to give you returns, but so does the risk associated with it.

Don’t take this post from an investment advice point of view. We are trying to understand where the market is shaping from an NFT perspective.

NFT is a space which can heavily incentivize people to take the right action. This concept is called a nudge theory. NFTs allow you to design the right type of incentives across different industries and streams.

Let’s dive into seven ways to make money with these incredible NFTs in 2023.

1. Make Money by Minting Your own NFTs?

Minting an NFT means publishing your digital asset on a blockchain so it can be bought, sold, and traded as NFT.

Like anything in this world, the amount of money you make ultimately depends on the effort you put into your craft. So, whether you’re an artist, developer, start-up, or full-fledged brand, you control how much money you make.

NFT creators can earn an average of $100 to over $1 million on average. This wide range is due to the many factors and ways that creators can earn money using NFT technology. On average, artists may sell their NFTs for $1,000 each, while developers can earn over $100,000 per year coding smart contracts.

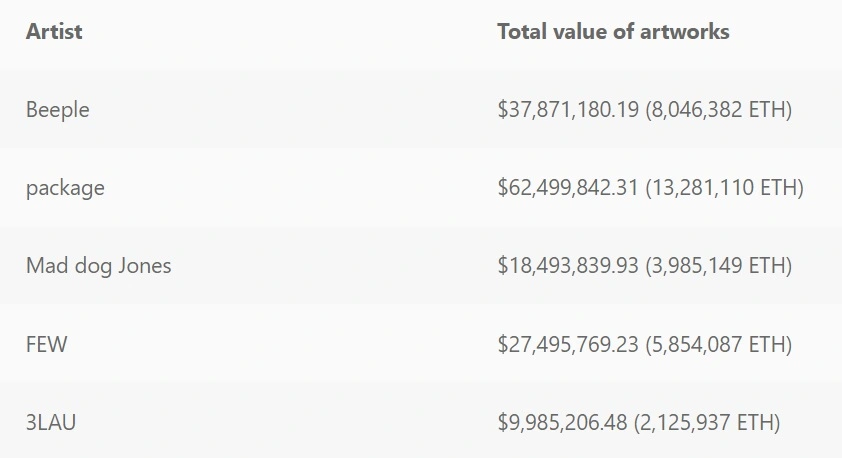

Here’s a snapshot of money earned by the digital art creators with NFT:

How to mint an NFT:

Step 1: Choose an item to mint as NFT.

This can be a unique / custom painting, music, meme, GIF, or even a tweet. Ensure that you are the original creator of this item, as rarity gives an NFT its value, and also prevent you from getting into legal trouble.

Step 2: Choose a suitable blockchain to mint your NFT.

This is important as you cannot transfer or sell your NFTs to other blockchains later.

The Ethereum blockchain is the most popular one, and Binance Smart Chain is one of the more affordable transaction fees. Additionally, these two blockchains host the largest markets for NFT and offer more exposure to NFT buyers.

Step 3: Set up a digital wallet.

This is necessary as Cryptocurrency funds your minting process, and a wallet provides access to your digital asset. Some of the best NFT wallets are Metamask, Trust Wallet, Coinbase Wallet, etc.

Step 4: Choose your NFT Marketplace

Once you own a digital wallet and some Cryptocurrency, you are ready to mint (hopefully sell) your NFTs. And for transacting NFTs, you need to choose an NFT Marketplace.

For the Ethereum blockchain, you can access a rich list of NFT platforms such as OpenSea, Rare and Mintable. The exclusive NFT markets of Binance Smart Chain are BakerySwap, Juggerworld, and Treasureland.

After choosing the NFT Marketplace, you need to link it to your chosen Digital Wallet to pay minting fees and hold any sales proceeds.

Step 5: Upload your digital file

The NFT Marketplace provides a step-by-step guide you have chosen for uploading your digital file to their platform. Following the same, you can turn your digital file, such as PNG, MP3, GIF, etc., into an NFT that can be bought and sold.

How to Sell a Minted NFT:

Finally, you can choose how to monetize your NFT according to the chosen NFT platform. You can sell at a fixed price, set a timed auction, or start an unlimited auction.

Unlike conventional methods of creating value by selling art, music, videos, memes, etc., an NFT offers greater flexibility for creators.

With NFTs, a creator can eliminate the intermediaries and still access the global market directly.

Creating an NFT version of your work and putting it up for sale in a trusted NFT market can optimize the marketing process that requires a lot of resources and money in conventional methods. And in the end, a fair share of the income is yours.

Additionally, NFTs allow continuous payment of commission to the original creator every time that item or artwork changes hands. You can schedule a royalty clause while coining the token so that subsequent sales of your artwork or digital item generate income.

Think of an NFT as a much-needed gateway to a democratized market to own, sell, and buy unique and rare digital assets.

However, Minting new NFTs is risky due to the lack of secondary market data to help you predict their value. There are several fees involved with minting and selling NFTs, such as fees for listing & minting, a commission on the sale, and a transaction fee (for transferring money from the buyer’s wallet to yours).

Considering these fees, you could also lose money on your NFT creation.

Hence it is crucial to ensure you sell an NFT that has demand in the marketplace and commands a price that will more than offset any associated fees.

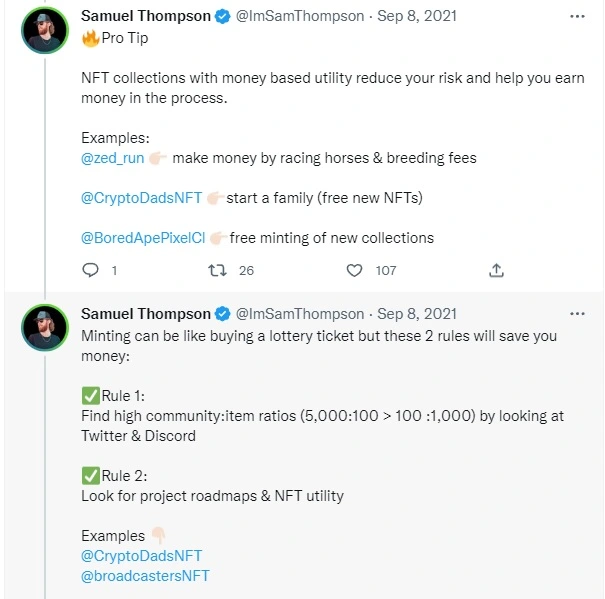

How to find the best NFT projects for minting? Here’s a Twitter thread from Samuel Thompson:

2. How to make money from NFT Royalties?

NFT royalties are one of the most significant ways to make money as an NFT creator. A royalty gives you a percentage of the sale price each time your NFT is sold on a secondary marketplace. Royalty payments are perpetual and are executed by smart contracts automatically.

If you are an artist and NFT creator, you can set a royalty rate for your work. Every time it is sold on the open market, such as OpenSea (the largest and most secure trading platform for NFTs), SuperRare, Rare etc., you will receive the defined percentage.

The artist or creator continues to earn income after the sale of the NFT, allowing them to maintain a part of the NFT sale price indefinitely.

The most common royalty percentage associated with NFTs ranges from 5% to 10%.

If, for example, the royalty rate for digital works of art is 8%, the original creator will receive an 8% payment every time the artwork is resold.

Please note that each marketplace NFT allows you to set your personalized royalty rate when you create your NFT for the first time. Obtaining NFT royalties is easy and does not require any additional experience. Everything is done from the interface of the NFT Marketplace. As with most things in the DeFi space, smart contracts are responsible for the entire royalty distribution process.

3. How to make money by Trading NFTs?

Another way to make money is from NFTs is by trading NFTs. Trading means buying and selling NFTs to make a profit.

It’s generally less risky because you have more data to understand the value.

Where to trade the NFTs?

NFTs are generally traded on a digital marketplace such as OpenSea and Rarible.

Here are the top 3 marketplaces to trade NFTs:

Crypto.com: Besides having an excellent reputation, the following features of Crypto.com makes it the overall best platform for trading NFTs

- Buyers don’t have to pay a fees

- There are a wide range of NFTs to choose from

- It accepts multiple payment methods (including debit & credit cards)

- Suitable especially for beginners

- It has an established NFT Trading Platform

Binance: best known for its crypto exchange services, Binance is also home to a wide variety of other crypto-centric products, including a fully-fledged Binance NFT Marketplace.

Binance NFT charges a low transaction fee (flat 1% trading fee). It has a large selection of NFTs and also provides access to events and rare NFTs. By offering mystery boxes, Binance allows you to own a rare and expensive NFT.

OpenSea: It is the largest and most secure trading platform for NFTs. Home to the famous Bored Ape Yacht Club series, the OpenSea NFT Marketplace has a massive collection of NFTs.

One exciting feature of Binance is that its platform supports multiple blockchain networks – including Ethereum, Polygon, and Klatyn. Also, OpenSea supports over 150 different payment options.

Rarible: An essential feature of the Rarible Marketplace is that it is decentralized. It means that you can trade NFTs without going through a third party. Also, it is home to a variety of NFT collections across digital art, books, movies, sports, and many more. Rarible also supports multiple blockchains. It provides Fee-free minting of NFTs, and Royalty fees can go as high as 10% for the creators.

However, the Rarible platform is costlier as trading on its platform attracts a commission of 2.5% for each transaction.

How to choose an NFT to trade/invest?

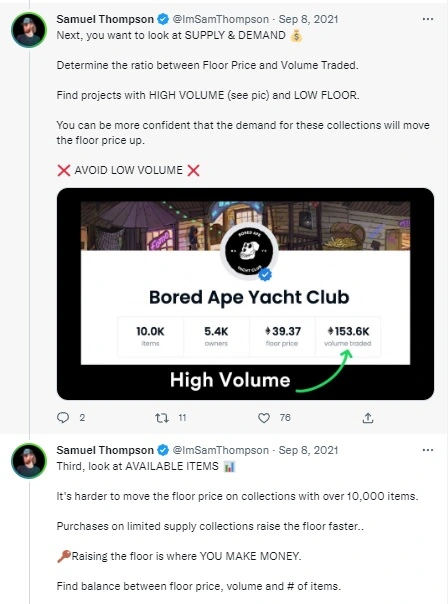

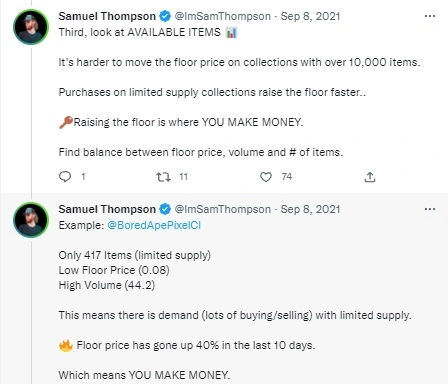

Here’s a screenshot of a Twitter thread from Samuel Thompson on how to choose which NFT to trade:

4. How to Make Money by NFT HODLing

HODLing may be your option if you are not looking for a short-term profit. In HODLing, you buy an NFT when prices are deemed low, with the idea that its price will increase in the future and you will have a significant return.

It is a long-term strategy that requires you to stay at least on the investment for six months, but it can be up to 5 years.

In a volatile market, it isn’t easy to guarantee a fixed profit. But in a buy and hold, there is a risk of losing even the initial investment.

The key here is to research before investing. Research the different types of projects and platforms available for NFT HODLing. Join relevant communities like NFT on Reddit to learn more about the different projects.

Choose the project or platform that fits your goals and preferences best, and then Invest in the project or platform of your choice. Monitor the progress of your investment and adjust your strategy as necessary.

Consider diversifying your portfolio by investing in different types of projects. Withdraw profits as needed and reinvest them to grow your income further.

5. How to Make Money by renting NFTs?

Renting is an excellent option for those who already possess NFTs that are in high demand and want to make money.

Nowadays, many Play-to-earn (P2E) games allow you to monetize your skills. And this has created a market for NFTs (gaming assets), which the gamers seek to improve their performance. The NFTs on this list are weapons that help players win against the most powerful enemies, tools that scale a mountain or help build houses or cool outfits for a player’s character (Skin). For example, some NFT card swap games allow players to borrow cards to increase their chances of winning.

Similarly, the explosion of the Metaverse has created a marketplace of houses, furniture, cars and fashion, all of which take the form of NFTs.

However, due to the high price of NFTs in demand, not all gamers and Metaverse residents can afford to own them. This is where renting NFTs in high demand comes into the picture.

One of the best aspects of this method is that it doesn’t require much time or money. Smart contracts govern the terms of the agreement between the parties. You need to enter the period you want to rent the NFT and the cost you want, and the blockchain will automatically search for the tenant for you, which will help create an opportunity for earning money for beginners.

Where to Rent out NFTs?

NFT Renting is a new concept. Hence, there aren’t many NFT rental marketplaces.

At present, you can rent your NFTs from three marketplaces – reNFT, Vera and Trava NFT.

OpenSea, one of the largest and most secure trading platforms for NFTs, is also allowing users to rent their NFTs.

6. How to Make Money by Staking NFTs?

If you are aware of staking cryptocurrency like Bitcoin (BTC) or Ether (ETH), then staking an NFT is a similar process. Here, NFTs are locked for specific periods in exchange for a reward.

Staking is the crypto world’s equivalent of earning interest or dividends while holding onto your underlying assets such as FD or Stock.

NFT staking works similarly to DeFi protocols, which allow the staking of cryptocurrencies in exchange for rewards.

However, compared to DeFi yield farming and crypto staking, NFT staking is still in its early stages.

Different staking protocols work differently and have their own rules and reward structures. To participate in NFT staking, you first need to hold the NFTs on a compatible crypto wallet.

However, not all NFTs can be staked to earn rewards. Some platforms allow you to use any NFT. In contrast, others require payment of native NFTs to acquire participation token incentives (that generally have a price on the native utility token of that platform).

After you hold the NFTs on a compatible crypto wallet, you would have to send the NFTs to a staking contract and lock them for a certain period.

Once the staking platform locks the NFTs, you start earning rewards. The reward system changes from one platform to another and depends on various factors.

Most of the NFT staking opportunities are currently available in Play-to-Earn (P2E) gaming and Metaverse platforms such as Axie Infinity, Decentraland, The Sandbox, Polychain Monsters, Splinterlands, etc.

Other staking platforms involve locking up the NFTs in DAO (decentralized autonomous organization) protocols. By locking NFTs in DAOs, you will have the opportunity to participate in the platform’s governance and vote on future proposals.

7. How to earn income from NFT-based Play to Earn Games?

What is an NFT game?

NFT or “Play to earn” (P2E) games are video games based on Blockchain technology. These are made up of characters (avatars) or collectible cards (NFT) that can be exchanged, bought or sold for monetary value.

P2E NFT games allow you to earn NFTs from playing the game. Instead of being a currency, this takes the form of a collectible in-game item you can sell to someone else. If the game is very popular, and the item is rare, then the NFT associated with it could be valuable, and you might make a significant sum of money from selling it.

Free NFT games are an easy and trendy way to earn NFT collectibles, which you can exchange for other assets. In other words, these games are ideal for making money.

Here are the five best free NFT games that can earn you real money:

- Axie Infinity

Created in 2018, Axie Infinity is one of the best free NFT games inspired by the famous Pokémon game. It’s great to start making money because it’s pretty straightforward. The game’s goal is to collect or raise Axies, which are fantastic characters with special powers facing each other. And that you can then sell or buy other players for the money.

- Gods Unchained

Gods Unchained is an exciting new NFT game which is free. It is a collectible card strategy game with fantasy creatures and mythological gods. Play as one of the four gods: Poseidon, Hekate, Zeus or Hades and build your army by acquiring cards and unlocking new skills through missions. Challenge other players in strategic battles on different battlefield maps to earn rewards or even get new characters.

- Tiny Colony

Tiny Colony is an extensive pixelated Metaverse and construction and management simulation game. Players can earn money in the game by building and running an effective ant colony, fighting with other colonies, and betting on community events.

Unleash your imagination with this easy and fun game, allowing you to win, collect and trade while entertaining.

- SplinterLands

This famous NFT game based on digital cards is one of the hopes to which all those who believe that NFT games are not a fad cling.

In SplinterLands (a collectible card game created in 2018), you must form squads to fight against other players. It is a free NFT game of decentralized collectible cards based on Blockchain technology. It is similar in concept to other games where the goal is to collect a collection of cards with different stats and skills used to fight against other players. Using Blockchain technology, players own their digital cards and can freely exchange and sell them as if they were physical cards without the control of a centralized company or organization.

- Alien Worlds

The player must have a WAX Cloud Wallet in Alien Worlds to access the registry. The Blockchain game is available on the Ethereum and Binance Smart Chain (BSC) networks. The German Company Dacoco developers continue to develop the project, adding revenue opportunities. According to statistics, the average income of players ranges from several tens to several thousand dollars a month.

Conclusion

Most associate NFTs with artwork or monkeys dressed in caps and glasses, but it is much more. For the more daring, there is the NFT investment market.

NFT, like Cryptocurrency, is a sunrise industry, and early adopters may benefit from it considerably. However, like with any investment opportunity, earnings aren’t guaranteed with NFTs.

The NFT ecosystem is fast growing and becoming more and more accessible to the masses. Above, we have told you about seven real ways to make money with NFTs. Whether you want to Mint, Trade, HODL, Rent or Stake NFTs, there’s a project out there for you to use.

If you are interested in saving your assets for a while, we recommend doing HODLing with NFTs. On the other hand, if you are one of the believers in the ‘high risk, high gain’ concept, you may look into NFT trading.

However, before choosing any way of making money through NFTs, educate yourself by researching and assessing which one best suits your way of investing and your current needs.

NFTs are futuristic investments, and ‘Educating Yourself Improves Your Odds of Betting Right on the Future.

Disclaimer :

This article will help you understand the nitty-gritty of NFTs as an avenue for Making Money. Please remember that this post is not financial advice or an endorsement of digital assets, providers or services. This is my subjective perception and, in no way, professional investment advice. Digital purchases are inherently volatile and risky, and potential regulations or policies can affect their availability and services provided. Only invest money you are willing to lose, and always talk with a financial professional before making a decision.

[…] For such value to be sustainable, NFTs must be more than just market and FOMO hype. Undoubtedly, the NFTs have taken the world by storm. More and more people are interested in How To Make Real Money With NFTs. […]