Guaranteed to give you a clear understanding of Blockchain, Cryptocurrencies, and options to set up a stream of passive income from Cryptocurrencies, if followed with Interest, passion & caution.

Quick Note: It took me several hours of research and effort to complete this blog post so that even a newbie to cryptocurrencies can understand. Even if you do not intend to invest in cryptocurrencies, I urge you to read through this article as educating yourself about it may improve your odds of betting right in the future. Also, I’ve tried to handpick the best strategies that can set up a stream of passive income from Cryptocurrencies for you in the future, keeping in mind the changing world order of finance. So, be assured of the results. Enjoy!

What is Passive Income?

Passive income is money earned from your assets without your participation. This can include earnings from a rental property, dividends from stocks, or any other similar type of income.

Earning interest on your bank accounts and, more recently, on your cryptocurrency holdings is another type of passive income. Essentially, any investment that makes money on its own is considered passive.

In order to gain a detailed view of passive income and its sources Read Here.

Why passive income from cryptocurrencies?

Cryptocurrency is a sunrise industry and can give great returns for early adopters! so if you learn about it, there are massive money-making opportunities in it.

We believe that this industry is destined to become a significant source of passive income, side income, or even full-time income. It will also generate a huge number of jobs.

It may sound too good to be true, but these cryptocurrencies are promising in themselves and should therefore increase in value anyway.

So, you are betting on two different income strategies at the same time.

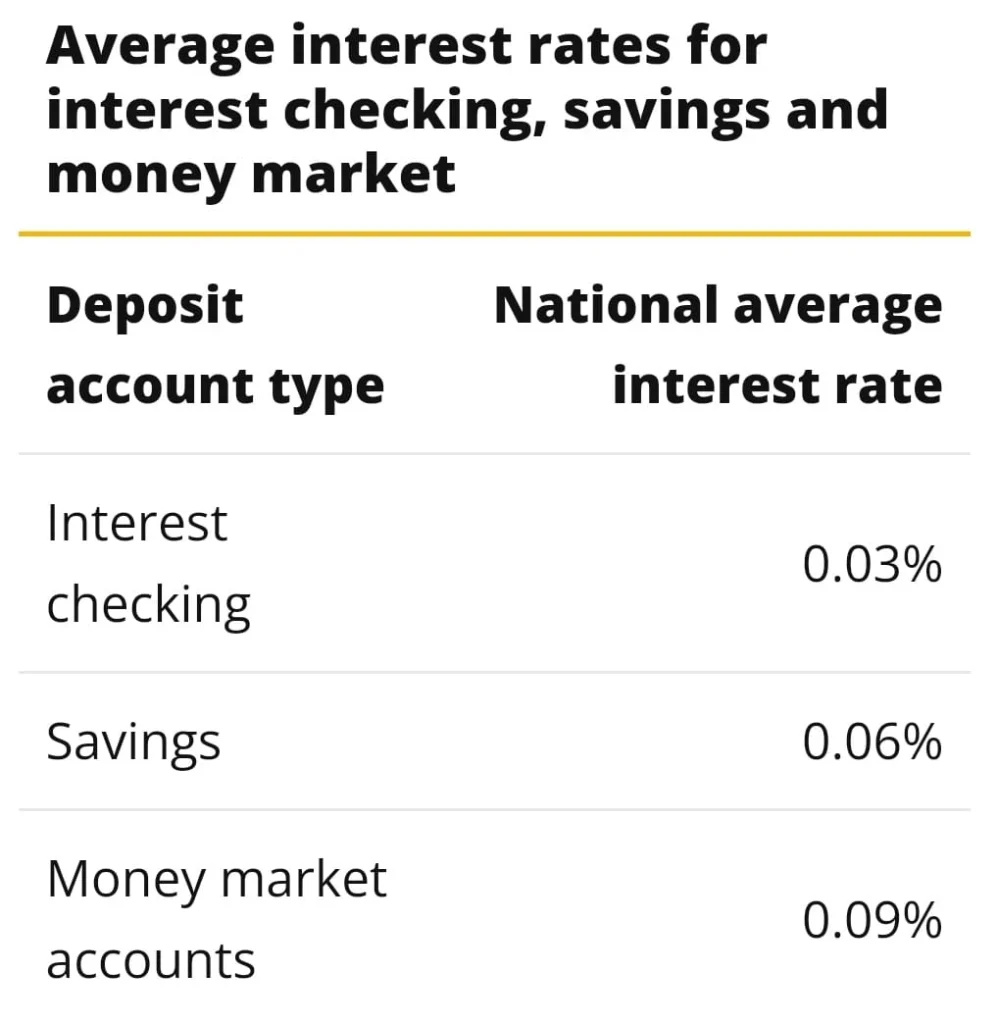

Take a look at the average interest rates for interest checking, savings, and money market in the USA:

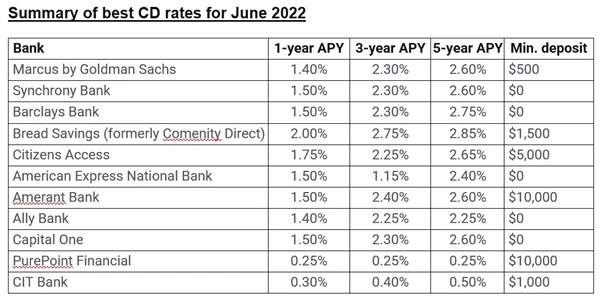

Now look at the best CD rates across different Banks in the USA:

If I make a fixed deposit or go and deposit my money in a traditional bank in the USA, in the best case scenario, I will earn roughly less than a 3% rate of interest on my hard-earned money.

Probably, in the near future, these Banks are going to charge their customers even to safe keep their money!

In contrast, if you consider earning passive income from cryptocurrencies, in the Crypto Yield Farming world, you can make returns up to 108 % APY! There are people who make even better returns!

What is Blockchain and its Consensus Mechanism?

Before talking about making passive income from Cryptocurrencies,

let’s start at the beginning: What is a blockchain and what can it actually do?

If you are already aware of these, you may skip this section.

As we know, Satoshi Nakamoto invented the Blockchain. We don’t know Whether he/she was a brilliant man/woman/ group. You can read his game-changing white paper here. A white paper is a blueprint explaining what it (cryptocurrency) is, it’s like a business plan for a businessman.

On January 12, 2009, the creator generated the first block in Blockchain and named it Genesis.

What exactly is Blockchain?

Suppose you sell a product online and I want to buy it from you. In order to execute this transaction on your website, I will have to use my credit card to transfer money from my bank account to your bank account.

Or let’s say I want to transfer $100 from the USA to my cousin in Singapore.

To do so, a couple of banks in the USA and Singapore are involved, and they deduct a fixed amount as a charge for this service.

Now, what if I tell you that we can make similar transactions without involving banks or governments, or any third party?

Blockchain technology makes it possible.

In layman’s language, Blockchain is a place for keeping records.

It’s like recording a database in blocks and connecting these blocks on a chain, hence the name – blockchain. Simply put, Blockchain is a revolutionary & extraordinarily secure way of transacting.

Why Should I Trust Blockchain?

Now you may ask, if we don’t have a bank account or government managing all these transactions, how secure is this? Who will guarantee the transactions? who will validate our transactions?

The answer is Blockchain itself!

When performing a transaction on the blockchain, the system records all data, including the sender and receiver, in individual blocks. Every block, or nodes on this chain, must verify and approve the transaction, requiring the majority to accept it for validation.

And that is why it is almost impossible to hack this system. This is precisely because it is not related to any central administration. It is rather a decentralized network where everyone in the chain must accept what is happening on this network. And this is what makes it very secure and almost impossible to hack.

So, these are the two main features of the blockchain: High security and Decentralization.

The third important feature is that the blockchain is public and auditable by anyone.

Blockchain is so made that you have complete visibility on every single transaction. So, anyone can browse/ explore the blockchain and see what is happening and see all valid transactions.

The fourth characteristic is that the data in the blockchain is immutable, which means that you cannot change or delete it.

Also, you can’t lose this digital ledger i.e., blockchain. The reason is that it’s a distributed ledger! This means, there is a ridiculous number of distributed copies of this blockchain over the Internet. So many backups that it can’t be lost. It lies forever. And precisely, this is why Blockchain is immutable i.e. you can’t alter or change it. This also explains that if you look at the chart of any network in the blockchain, say bitcoin blockchain, you’ll see that the data is always increasing. We are always adding data that we can’t delete or change so it’s always expanding.

What is Cryptocurrency?

Now, since we want to work on the blockchain, we need a currency that works on the blockchain and that is why we need a cryptocurrency.

Crypto means the currency that works under some cryptographic algorithms, called Mathematical Algorithms, related to cryptography.

So, when you want to transfer money from someone to another on the blockchain, you can’t use dollars or any similar fiat currency. You have to use cryptocurrencies like Bitcoin, Ethereum, Cardano, etc. for transfer.

Blockchain is to cryptocurrency, what the internet is to email, or what land is to farmers.

Blockchain is not just limited to cryptocurrencies. You can make any kind of transaction on the blockchain and save it on this secure network.

For example, we said that all information on blockchain is permanent and highly secure.

It’s so secure that in the future, we may have election data, health data, historical data, etc., which no one can tamper with.

With Blockchain, there’s no central authority overseeing all the activity.

When examining any blockchain network, whether it’s Cardano, Solana, Bitcoin, or Ethereum, the system must verify or validate any data added to the blockchain.

It uses various mechanisms for verification/ validation to ensure that multiple network participants, who do not know each other, agree on the accuracy of the information contained in a block, in order to then put a digital stamp or seal on it.

These transactions are processed in two ways which are called Consensus Mechanism.

The Two types of Consensus Mechanism

Below are the two main types of Consensus Mechanism:

Proof of work (PoW):

The process of validation in PoW is called mining. And there is a reward whenever you mine.

The reward goes to whoever makes the blockchain more secure. Miners crack the code, solve the puzzle, or open the lock of the block, using the solution to secure the block and the subsequent blocks. In return, the miner receives a reward in the form of Bitcoin. Thus, you are being rewarded for securing the blocks.

Isn’t capitalism an amazing motivator?

Thus, by cracking the code I am proving that I am working and making it more secure- we refer to it as Proof of Work (POW). PoW relies on computing power to solve complex algorithmic problems that reward users with cryptocurrency. The problem with proof-of-work is that it’s very energy-intensive.

It takes a lot of money to start up. And with increasing levels of difficulty in solving the algorithms, it could take longer and longer to get paid.

Proof-of-Stake (PoS):

The second solution is what we call Proof-of-Stake. Proof-of-stake is a way of reaching consensus (being able to verify those transactions itself) on certain blockchain networks.

It is considered a more efficient method of achieving consensus on the blockchain than the classic proof-of-work used by Bitcoin.

In the Proof-of-Stake scheme of things, people, who validate the data are called validators.

Almost all third-generation blockchain projects, i.e. those that came after Bitcoin and Ethereum, use the Proof-of-Stake mechanism which uses less power.

Staking and Liquidity Pooling:

Let us understand the key difference between Staking and Liquidity Pooling.

Staking is a very broad term and it can be used in multiple contexts.

For example, you would have seen that whenever VCs or Angel investors invest in a particular start-up, they receive a certain amount of equity in return. In other words, they own a particular stake in the company.

What is the advantage of owning this stake? Of course, they get a certain amount of return if the business does well. Besides, they would support that business in terms of growth. This is because they’re an equity holder in that company. And their fortunes are somewhat tied to that company’s growth.

A similar concept is applied in the crypto world where you end up staking your cryptos.

Before You see various ways to stake and earn passive income from cryptocurrencies, let’s understand about Staking.

What Does Staking Your Crypto Mean?

Different Blockchains work on different Consensus mechanisms.

For example, Cardano works on the PoS concept and here you become a validator, and only if you have a certain stake in Cardano.

So, in order to become a validator on Cardano, you need to have certain ADA (Cardano) points.

Similarly, there are many other blockchain networks that work on proof of stake consensus mechanisms, and there, in order to become a validator, you need to own a certain equity or a certain number of coins to become those validators.

When you become a validator, the benefit is that you end up getting rewards every time a verification is done via your end. This is the reason why people become validators of the PoW consensus mechanism.

Another key aspect of staking is that sometimes people simply go and stake their coins.

For example, if you have a specific number of bitcoins, Ethereum, and other different cryptos, you will go and stake your coins in certain liquidity pools.

What Are Liquidity Pools?

The liquidity pool is like your bank account.

If you give your bank $100 in your bank account, the bank will take it and lend it out to other people. In return, the bank makes a certain commission- maybe 2% or 3% or more. This is how a bank operates.

Liquidity pools also work in a similar way. If you have $100 worth of bitcoin, you would go and give it to a crypto bank, which could be protocols like Aave or Compound.

Because this financial model operates on the decentralized blockchain, meaning there’s no central authority controlling it, it is called Decentralized Finance or DeFi for short.

These crypto banks or protocols, lend out your $100 worth of bitcoin further to people who need those cryptos and in return will make a certain commission. Then they will pass on that commission to you. So, this is what broadly a liquidity pool is.

Staking has two primary utilities:

One– you can stake your cryptos and become a validator on certain blockchains

Second– you can stake your crypto coins on digital banks like Aave & Compound etc. and in return, you will be making a certain rate of interest or yield.

Now, this brings us to two additional concepts on DeFi:

Liquidity Pooling and Who Are Liquidity Providers?

Simply put, Liquidity providers, are people who want to provide liquidity.

This is a slightly more advanced version of staking.

Staking is very broad and has two primary functionalities- one is staking your coins on a blockchain network for validation purposes and the second is that you are staking your coins in liquidity pooling.

Liquidity pooling is primarily done in order to make certain yields or say returns from that liquidity pool. These are of two types:

Centralized finance and Decentralized finance.

Centralized finance could be an exchange-based liquidity pool such as VaulD. On VaulD if you are purchasing cryptocurrencies, you get an option of doing a fixed deposit on that currency.

For example, if you buy bitcoin then you can do a fixed deposit and you will get roughly a 6.7 API on bitcoin. Similarly, if you are doing your fixed deposit on USDC or USDT, then the amount of returns goes up.

So, the returns depend from coin to coin.

Thus, protocols like VaulD are CeFi (Centralised Finance) liquidity pools where you can stake your money in order to make certain returns.

The second category is DeFi protocols, for example. protocols like PancakeSwap, Sushi, Compound, and Aave, where you can go and stake your money and make a certain return.

DeFi Protocols or CeFi Protocols: Which Is Better?

Honestly, there is no one right answer.

According to us, it depends on a few key factors.

First and foremost: How comfortable you are in the DeFi protocol ecosystem.

If you don’t understand DeFi and are not comfortable with it then using CeFi exchanges will make a lot more sense.

Two: Ease of usage.

CeFi protocols like VaulD are very smooth & easy to use, the user interface is very convenient.

Three: Time.

If you’re pressed for time and find it cumbersome to track your day-to-day yield, the CeFi protocol makes a lot of sense. The process of scouting for the best possible yield is called yield farming.

This entire process of yield farming comes with a series of risks. If you are going to a DeFi protocol, the chances of making yield go up, and so does the risk.

Risks involved in the DeFi ecosystem

There are some salient risks involved in the entire DeFi ecosystem and more prominently around the concept of yield farming, liquidity pooling, and Staking.

There are four key risks that exist in these DeFi ecosystems.

One: Rug Pull risk.

It simply means that often, a new coin launches generates a lot of hype, and might lure you into investing or staking your money in it. Subsequently, the developers abandon that ecosystem, preventing the project from even getting started. This act of developers leaving the protocol and taking away your money is referred to as rug pulling. Unfortunately, it’s a very risky thing and happens quite frequently in the crypto world.

Also, in the crypto ecosystem, there is a lot of decentralization and one aspect of decentralization is that launching a crypto coin or launching an NFT is quite easy and anyone can do it and find a target audience to invest in these projects.

This is both a disadvantage as well as an advantage of the crypto ecosystem.

How to avoid these rug pull schemes?

We as crypto investors need to do a thorough analysis before investing our hard-earned money.

At least go look at the discord server, the telegram group, or Twitter as to what are the creators of the project posting. Read and understand what is the utility of the coin, go read the white paper. If you simply go through this process, you will be able to avoid at least 99 of these rug-pull scams.

Two: Regulatory Risk. A lot of the DeFi universe is unregulated right now. So, governments keep on coming up with new laws and regulatory frameworks.

So, anytime a new law or a new framework comes into the system, it may impact the points that you are staking.

Three: Volatility Risk. The crypto market is a fairly new asset class and hence very volatile. So, if you are staking your coins on your own and you are trying to become a yield farmer on your own, you need to stay on top of things. If you can’t do it, then go via CeFi platforms.

Four: Smart Contract Risk. Many times smart contracts themselves can get hacked. It happens often on bad protocols but on good protocols, this hacking does not happen because they ensure safety. For example, no one has successfully hacked Bitcoin. While Bitcoin exchanges have been hacked, the Bitcoin Blockchain Network itself remains secure.

Thus, Yield Farming, Liquidity Pooling, and Staking- are all innovative concepts in the DeFi world and are evolving fast. It’s a fascinating space and there is a great opportunity to make money.

In this industry, it is very important to stay on top of things and follow the basic investment principles like identifying the utility of the coins before investing and staying a little bit diversified.

Before we move ahead, there’s another concept or aspect of blockchain that you must understand and that is NFT.

What are NFTs (Non-Fungible Tokens)?

Suppose I have $500 and if I want to give you $100, do you care if I give you any specific bill? Alternatively, I can also send it through bank transfer. It’s the same. So, there’s nothing unique about each bill and they all have the same value.

Secondly, this 100$ can be split into parts 10, 20, and 50 $s, so u can combine and form a 100$. So, these dollars are fungible.

NFTs are non-fungible tokens. It is something that we can’t split and is unique.

Suppose, there’s a painting. Do u want to buy a copy of this painting/token or the original? Also, you would want to ensure that it’s from the correct artist.

So, this original painting is unique and can’t be split. The value lies in its uniqueness. Obviously, these tokens are digital.

Thus, NFT is a digital asset. It can be a simple picture, a tweet, a picture of Tom Cruise, and so on.

Something called a CryptoPunk is one of the most sought-after NFTs which sells for millions of dollars. These were among the earliest NFTs in the world, being the first to be minted, unique, and super rare. Currently, there are 10,000 CryptoPunks, each valued at a very high price. The utility of CryptoPunk is that these are very rare NFTs.

NFTs are also of multiple types. For example, one of the key types of NFTs comes out in the form of gaming metaverses.

God of War is a very famous video game. It is basically a metaverse, a planet in itself. On God of Wars, you can buy swords, axes, and a bunch of skins. These are digital assets that are only applicable to the God of War universe.

Suppose You buy a weapon, say a Sword, on God of wars, you buy it with real money, say for $50.

Now, once you buy it, you can only use that sword on the God of wars. The utility gets over. You can’t sell it publicly or You can’t sell it and get your money back. This is because the economics does not support this.

This becomes a limitation for the underlying value of this digital asset. This problem/ limitation is solved in the crypto metaverses.

In Crypto Gaming Metaverse, such as Sandbox, Axi Infinity, Decentraland, etc., you possess NFTs, which are essentially skins used in that gaming metaverse.

Now, there’s a platform called Open Sea where you can sell and buy these NFTs.

Besides these skins, you will also see some different NFTs. For example, on Decentrala and Metaverse, you can buy a piece of the virtual plot. So essentially a piece of land on the Decentraland metaverse is an NFT, a digital asset.

So that’s pretty much about NFTs.

Let’s come back to our discussion. There are lots of ifs & buts in the Crypto Universe, but as Wayne Gretzky, the greatest hockey player ever & author of ‘Playing With Fire’ put it:

“He was successful not because he skated to where the puck is but he skates to where the puck is to be”

Wayne Gretzky

Similarly, with investments, we want to invest in investments that people are going to like. If we chase the investments that everyone is chasing right now then there are really not that many incremental investors and like Warren Buffet said:

“we need to be greedy when others are fearful and fearful when others are greedy”

Warren buffet

With this in mind, now that you have a fair knowledge of, Blockchain, Cryptocurrencies, Consensus Mechanism, DeFi & CeFi, Staking and liquidity Pooling, etc., let’s dive into this fascinating world of cryptocurrencies with a view of creating a passive source of income from it.

Top 5 Ways to Start Passive Income from Cryptocurrencies:

Passive Income from Opening Interest-bearing Crypto Account

Probably the easiest, quickest, and most straightforward way of making passive income from cryptocurrencies is through an interest-bearing account.

Just like you get an interest rate in a general bank deposit account, in the case of Cryptocurrencies, you could deposit your cryptocurrency through several exchanges and earn a pre-set return depending on the amount you hold.

There are many Centralized Exchanges (CEX) like Binance or decentralized ones (DEX) like DeFi Swap. These are Crypto Wallets and service providers that allow their users to open an account, purchase specific tokens, and block them in their account. By blocking tokens, it is possible to earn a return.

Crypto service providers that offer such products include, ‘Nexo’, ‘Celsius Network’, ‘SwissBorg’, ‘BlockFi’ etc.

Believe it or not, the return is actually pretty good. For example, BlockFi pays as high as 4.5% on Bitcoin, 5% on Ethereum and 9% on USDC.

Celsius pays even more at up to 8% on Bitcoin, 7% on Ethereum and nearly 11% USDC, and Voyager pays the same interest rate regardless of how much you hold on the platform.

However there are some downsides, and in addition to that, there is no FDIC insurance, and putting your savings into crypto can still be really intimidating for many new beginners.

However, some reputable exchanges, like Gemini, are considered among the safest. At Gemini, you can buy, sell, store, and earn interest on your cryptos. These exchanges are secure because the NY State Department of Financial Services heavily regulates them, and they implement industry-leading security measures on your account.

Not only do you earn a higher interest rate from an interest-bearing account with cryptocurrencies, but you can double down on the fact that the value of the underlying cryptocurrency (good ones of course!) may also appreciate substantially in the long term.

Now, the question is – how are they able to pay out such high-interest rates when banks are barely able to pay out anything?

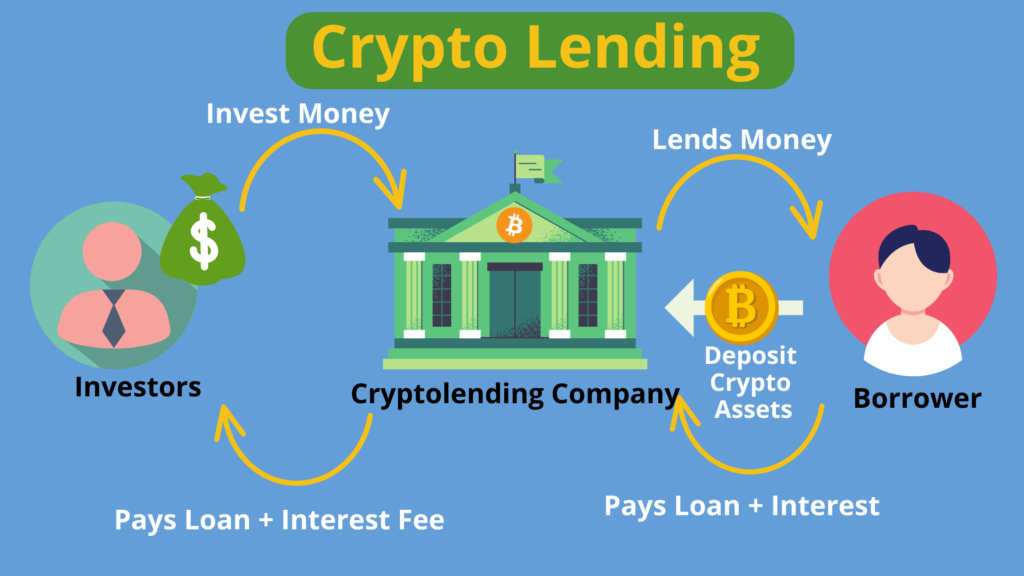

When you deposit money in one of these platforms, they lend this money to retail and institutional investors at a higher interest rate. It’s like you give us your money and we will pay you a 5% interest rate. Then we could lend that money to somebody else at 8% and we profit from the difference.

Furthermore, in the cryptocurrency lending space, we minimize middlemen and expenses, similar to lending fiat currencies, to the lowest possible level. This allows us to pass on the benefits to the end user.

And precisely, that’s why Stable coins pay significantly more than the rest, because there’s universal demand for a Stable coin which is pegged one to one to the USD or another fiat currency. Also, they’re a lot less volatile.

Stablecoins are essentially Cryptocurrencies where prices are pegged to fiat money, cryptocurrency, or to an exchange-traded commodity.

Passive Income with Cryptocurrencies through Staking

The second option for earning passive income from cryptocurrencies is what’s known as Staking. As discussed earlier in this post, staking-type networks use Proof of Stake as a consensus algorithm.

With staking, small investors can participate in this consensus process and earn interest.

In other words, by staking, you help the growth of cryptocurrencies.

The interest rates mentioned here, known as staking awards, pay you rewards in the form of the corresponding coins. In this case, staking more money increases the chances of validating the next transaction and receiving higher payments.

Then you can join something called the staking pool. It combines forces and then shares the collective reward of placing more money within the network in the simplest form. Imagine staking like you’re putting money in a CD for 1 to 24 months, and in return for that, you get a slightly higher yield.

Beginners can start by signing up for a reputable exchange like FTX, Coinbase, or Binance. Compare interest rates, investment periods, and the amount you want to invest. Then follow the instructions provided by the chosen exchange.

However, there are certain associated risks with staking.

For example, when you stake your cryptocurrency, its value will continue to fluctuate as long as it remains deposited. You will put your money in the blockchain for, sometimes, an indefinite period of time, during which the market could fall and you’ll be unable to sell.

Many solutions for staking with stablecoins are emerging. Stablecoins are cryptocurrencies that are linked to fiat money, like dollars. They have lower volatility compared to other cryptocurrencies.

The reward will depend on the cryptocurrency you are staking with.

Among the most used cryptocurrencies are Binance Coin, Cardano, Polkadot and Ethereum 2.0.

Overall Staking could be a great way to earn passive income with cryptocurrency that you were planning to hold for the long term anyway, as long as you don’t need to sell anytime soon.

Passive Income from Crypto-lending

The third way of making passive income from Cryptocurrencies would be lending. Crypto lending is also a way to earn passive income from cryptocurrencies.

You lend your crypto to other parties and get them back with corresponding interest. However, it is important to do good research here, because the risk of loss is higher with crypto lending than with staking but the reward might be worth it.

As with staking, the value of the cryptocurrencies you lend will continue to rise or fall as long as you keep them on the platform.

Again, the profitability depends on the crypto asset you deposit, and, again, if you want to avoid volatility, the expert recommends using stablecoins.

Also, the biggest risk of this system is that you are lending your money to a third party for all purposes.

Choosing a platform that executes the process well is one of the keys to avoiding problems. In addition to the well-known ones, there are specialized services such as Celsius Network or BlockFi.

Passive Income from NFTs

A better alternative to earn passive income from cryptocurrencies directly could be NFT or “Non-fungible Token”, a digital, unique, non-reproducible work.

There are different ways from which you can make passive income from these NFTs. The first one is Staking.

Staking NFT, simply means that you have an NFT, a digital asset, and you go on a platform like VaulD where you can keep this digital asset and receive a certain rate of interest on it, ranging from x% to y%.

This is somewhat similar to availing gold loans by keeping some amount of gold you own with an agency that provides Gold Loan.

You keep your gold, say 20 grams, with them, and in return, get some money / some APY / some interest on that gold. So, you will start making let’s say 2% on your gold loan/ interest.

In crypto parlance, when you do this via NFT through a platform like VaulD, you make a lot more money, sometimes up to 108%.

Of course, there is risk, but then, with risk comes rewards. Even good large-cap stocks have risk.

In the crypto world, you can scout for a very high yield and this is yield farming. Simply put, in Yield farming, when companies are paying you 36% return, they, in turn, are making 108% or 180% yield on that same money, because they are doing something called yield farming.

Staking or Yield Farming is not something new.

People are already engaging in it directly, but doing so is quite complicated and involves much higher risk. So as normal retail investors investing in NFT and then sticking to it is probably the most sensible way of staking our money and earning decent rewards on it.

Since 2021, NFTs have primarily revolutionized the art market. There are now an extremely large number of NFT collections of digital artworks that you can buy, sell, and trade on platforms such as OpenSea.

Then, there are sites like renft.io that offer a protocol where NFT owners could lend their NFTs to someone else for a set period of time and price. This is with the assurance that after the agreed time frame is up, the person gets their asset back.

You might ask, why would anyone do this? Well, it’s just like people rent a Lamborghini for a day to show off to their friends or even rent a Rolex for an entire month.

People could rent NFTs to display or there’s also the possibility of renting out gaming NFTs to different players as a way to level up their character.

There’s also the chance to earn NFT royalties, when it changes hands in the secondary market.

Passive Income from Crypto Affiliate Programs

This is probably the simplest way to earn passive income from cryptocurrencies and blockchain. And that too without investing or without going deep into this piece of revolutionary tech.

This industry is still in its nascent phase in respect of acceptability. So, several digital currency companies have created certain incentive schemes that will reward you for attracting more users to their platform.

These include sharing affiliate links, referrals, or some other discount offered to new users you introduce to the platform.

If you have a large following on social media (Twitter, Instagram, TikTok, Facebook, etc.), affiliate programs can be a great way to earn a passive income.

However, in order to avoid spreading the word about low-quality projects, it’s always worth researching services beforehand. This is especially important if you care for your followers in the long term.

Crypto Mining: No More for Common Man

The most well-known method of making some moolah in the cryptocurrency industry is Mining. However, I have not included it in the list and you must be wondering Why?

As discussed earlier, Mining is the process of validation in the Proof of Work (PoW) consensus mechanism. Essentially, mining is the use of computing power to secure the Blockchain network and earn a reward.

In the early days of Bitcoin, mining on a classic Central Processing Unit (CPU) was a useful solution. When the network hash rate increased, the majority of miners switched to more powerful graphics processing units (GPUs). Hash Rate, simply put, is the speed of mining measured in units of hash/second).

Now, with increased competition, mining has become almost exclusively the playing field of Application-Specific Integrated Circuits (ASICs). ASICs is a technology that uses mining chips specially designed/adapted to this application process.

Today, companies with significant resources dominate the highly competitive ASIC industry, using them for research and development.

In short, bitcoin mining is mostly corporate and no longer a viable source of passive income for the average person.

More Ways to Make Passive Income from Cryptocurrencies

Other than the 5 ways discussed above, there are other legit ways to make passive income from the crypto world such as:

- Run a Lightning node

- master nodes

- Forks and airdrops

- Blockchain-based content creation platforms

However, the above-mentioned options require a slightly advanced level of knowledge and expertise and require a dedicated post.

Subscribe to the newsletter to learn more and more such new age instruments to learn legit ways of earning passive income.

Overall, building a passive income with cryptocurrencies is not that difficult.

However, You have to be aware that it takes some time and your passive income will be rather small at the beginning.

All the above strategies are worth exploring for earning passive income. But for most people, simply Staking or Holding your coins in an interest-bearing account would be the easiest approach. This is so while maximizing the amount of work and minimizing the risk involved.

Of course, nothing is risk-free and there’s always a chance you could lose money. However, to lessen those odds, it’s always a good idea to use multiple exchanges. Spread your money throughout as many different places as possible and insulate yourself in the chance that something happens to one of them.

But as a way to earn a passive income without being actively involved, all of these are at least worth looking into. And this is how I have been able to make a passive income just by holding on to my cryptocurrencies and staying invested.

The amount of money you will make with any of the options mentioned above will clearly depend on:

- Amount invested

- Choice of method- Lending/ Staking/ NFT etc.

- choice of Cryptocurrency e.g., Ether / Aave/ Bitcoin, etc.

Let’s take the example of Staking as a method, stablecoins as the chosen cryptocurrency, and $10,000 as the invested amount.

In the current scenario, you can receive an annualized yield as high as 12.3% if you stake Tether coins (USDT) or a slightly lower yield of 12% with USD Coin (USDC).

An investment of $10,000 in either of the cryptocurrencies could easily and passively generate an annual income of $1200 or $100 a month.

Besides stablecoins, there are other cryptocurrencies using the PoS consensus mechanism that offer much better yields plus the opportunity for price appreciation.

For ex. when you stake Solana (a popular PoS cryptocurrency), annualized yield can be as high as 15%.

Besides, Solana’s price has risen more than 120% in the past 12 months. Earning potential from cryptocurrencies is directly proportional to the amount of risk you can take.

Before even considering this mode of passive income, you must understand the basics and risk-reward proposition of Cryptocurrencies. And believe us, there lies immense earning potential in it (and so is the risk of losing everything!)

Conclusion:

As nice as the passive income from cryptocurrencies fantasy sounds, it is a risky investment. This is because no one can see the future and we therefore do not know which cryptocurrencies will be around in the long term. This fact clashes very much with the goal of passive income.

Therefore, one should carefully consider the decision to invest in something as risky as cryptocurrencies.

There’s high risk. But, along with this, there’s an opportunity to actively engage in this sunrise industry now. And later, achieve insanely higher profits than any other investment avenues available today.

Notice:

I hope this article will help you understand the nitty-gritty of cryptocurrencies as an avenue for passive income generation. Please keep in mind that this is my subjective perception and in no way professional investment advice. Do not invest money that you are not willing to lose.

Also, stay away from offers that promise you a monthly profit of xxx$ or xxx%. This is because nobody can promise such a profit. Especially when it comes to very large sums, there is usually a scam with obscure names (Onecoin, Swisscoin, Platincoin, Bitconnect) behind it.

[…] 5 Legit Ways For Passive Income from Cryptocurrencies NOW! […]